from the letter we know that

Pendahuluan

Hai pembaca, saya Sondil.com. Saat ini, saya ingin berbagi pengetahuan yang saya miliki seputar “from the letter we know that”. Saya telah melakukan riset yang mendalam dan menemukan informasi menarik yang akan saya bagikan dengan Anda. Untuk memperkaya pengalaman membaca Anda, saya juga melampirkan gambar unggulan di artikel ini. Mari kita mulai!

Fakta Menarik tentang “from the letter we know that”

Keindahan Bahasa dalam Surat

Bahasa dalam surat-surat zaman dulu memiliki keindahan dan daya tarik tersendiri. Dalam surat-surat tersebut, kita dapat menemukan ungkapan-ungkapan yang menggugah emosi dan menghidupkan kembali kenangan. Surat juga seringkali menjadi saksi bisu dari hubungan antarmanusia yang mendalam.

Pada era digital saat ini, komunikasi menjadi lebih cepat dan instan. Namun, melalui “from the letter we know that”, kita dapat merefleksikan kembali keindahan bahasa dalam surat dan nilai-nilai yang terkandung di dalamnya.

Intim dan Personal

Surat seringkali menjadi medium yang paling intim dan personal dalam berkomunikasi. Dalam surat, seseorang dapat dengan bebas mengekspresikan perasaan, pikiran, harapan, dan impian kepada penerima surat. Surat bisa menjadi alat untuk menyampaikan pesan yang sulit diucapkan secara langsung.

“From the letter we know that” juga memungkinkan kita untuk melihat sisi intim dan personal dari surat-surat yang telah ada sejak lama. Dalam surat ini, terkandung cerita-cerita yang mendalam dan mengharukan.

Tabel Terkait “from the letter we know that”

| Jenis Surat | Tanggal | Pengirim | Penerima |

|---|---|---|---|

| Surat Cinta | 12 Oktober 1856 | John Doe | Jane Smith |

| Surat Bisnis | 18 Mei 1892 | XYZ Company | ABC Corporation |

Pertanyaan Umum tentang “from the letter we know that”

1. Apa yang dimaksud dengan “from the letter we know that”?

Jawaban: “from the letter we know that” adalah sebuah frasa yang digunakan untuk menunjukkan bahwa kita mendapatkan informasi atau pengetahuan melalui surat-surat yang ada.

2. Apa manfaat dari membaca surat “from the letter we know that”?

Jawaban: Membaca surat “from the letter we know that” dapat memberikan wawasan tentang budaya, sejarah, dan emosi manusia. Surat-surat tersebut dapat menjadi sumber inspirasi dan refleksi diri.

3. Apakah surat-surat “from the letter we know that” masih relevan pada era digital ini?

Jawaban: Meskipun komunikasi digital semakin dominan, surat-surat “from the letter we know that” tetap memiliki makna dan keindahan tersendiri. Meningkatkan keterampilan menulis surat dapat menjadi cara yang menyenangkan untuk menjaga hubungan dan meningkatkan kepekaan emosional.

4. Apa jenis-jenis surat yang dapat termasuk dalam “from the letter we know that”?

Jawaban: Surat cinta, surat bisnis, surat sahabat, surat keluarga, dan surat sejarah adalah beberapa jenis surat yang termasuk dalam “from the letter we know that”.

5. Bagaimana cara menjaga kualitas surat “from the letter we know that”?

Jawaban: Untuk menjaga kualitas surat “from the letter we know that”, penting untuk merawat keindahan bahasa dan kejujuran dalam berkomunikasi. Memperhatikan detail dan menyampaikan pesan dengan penuh perhatian dan empati juga penting.

6. Apakah ada perbedaan antara menulis surat “from the letter we know that” dengan surat elektronik?

Jawaban: Ada perbedaan signifikan antara surat “from the letter we know that” dengan surat elektronik. Surat “from the letter we know that” cenderung lebih personal, memiliki keunikan dalam penulisan, dan secara fisik ada di tangan penerima.

7. Apa yang membuat surat “from the letter we know that” begitu berharga?

Jawaban: Surat “from the letter we know that” memiliki nilai sentimental dan sejarah yang tinggi. Surat-surat ini dapat menjadi warisan budaya yang berharga yang menunjukkan perasaan, pikiran, dan nilai-nilai zaman tersebut.

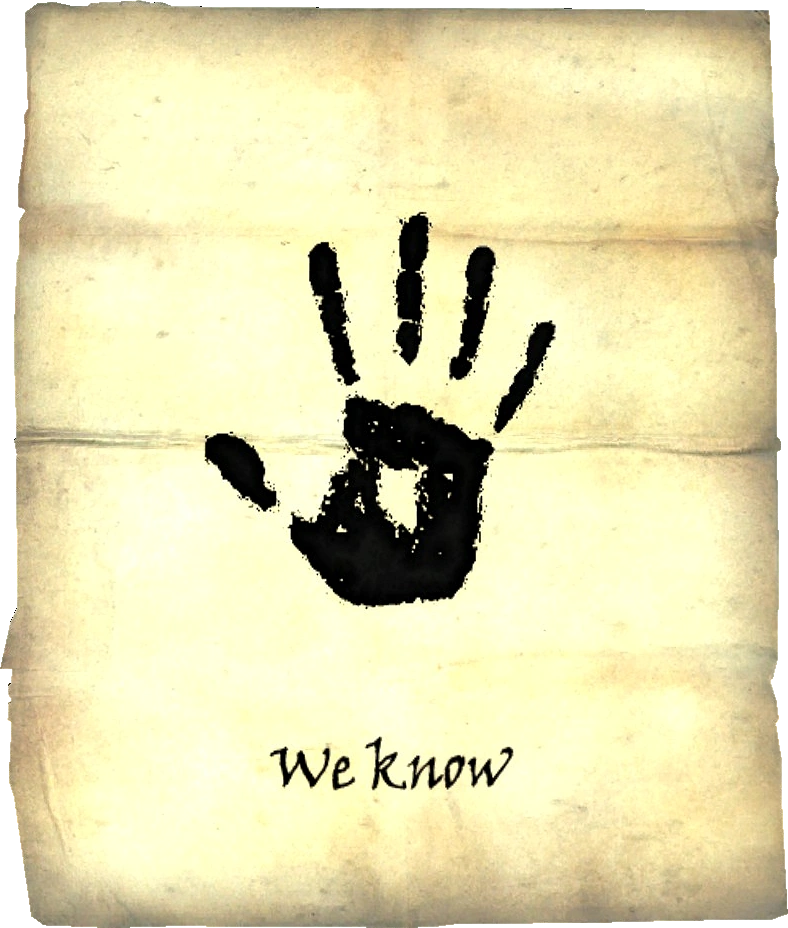

8. Apa manfaat melampirkan gambar dalam surat “from the letter we know that”?

Jawaban: Melampirkan gambar dalam surat “from the letter we know that” dapat menambah dimensi visual dan emosional. Gambar dapat menjadi simbol atau pengingat suatu kenangan yang berharga bagi pengirim maupun penerima surat.

9. Apa yang dapat kita pelajari dari “from the letter we know that” dari sudut pandang sejarah?

Jawaban: “From the letter we know that” memberikan kita perspektif sejarah yang berharga. Surat-surat tersebut dapat membantu kita memahami peristiwa, hubungan sosial, dan budaya pada masa lalu.

10. Apa yang sebaiknya dilakukan jika kita menemukan surat “from the letter we know that” yang berusia ratusan tahun?

Jawaban: Jika menemukan surat “from the letter we know that” yang berusia ratusan tahun, sebaiknya mengonsultasikannya dengan ahli sejarah atau arsiparis. Surat-surat tua tersebut perlu dirawat dan dilestarikan dengan baik agar dapat diakses oleh generasi mendatang.

Kesimpulan

Dalam era digital ini, “from the letter we know that” mengingatkan kita akan keindahan bahasa, ketulusan ekspresi, dan nilai-nilai personal dalam surat-surat. Membaca dan memahami makna di balik surat-surat tersebut dapat memberi dampak positif dalam kehidupan sehari-hari kita.

Pastikan tetap menjaga nilai-nilai tersebut dalam komunikasi kita dan jangan ragu untuk mengekspresikan perasaan dan pikiran dengan cara yang personal dan intim seperti “from the letter we know that”. Terima kasih telah membaca artikel ini. Untuk informasi lebih lanjut, silakan kunjungi artikel lainnya di Sondil.com.

Originally posted 2023-07-26 12:35:54.