when would it be best to consume the product

Sondil.com

Assalamualaikum Pembaca setia Sondil.com. Hari ini kita akan membahas topik yang sering menjadi pertanyaan banyak orang, yaitu “When would it be best to consume the product?”. Sebagai seorang Dosen yang memiliki pengalaman dalam bidang ini, saya akan membantu Anda memahami lebih dalam tentang waktu terbaik untuk mengonsumsi produk tertentu.

Why Timing Matters

Bagian ini akan membahas mengapa waktu sangat penting dalam mengonsumsi produk dan bagaimana hal itu dapat mempengaruhi penyerapan nutrisi dan hasil yang Anda dapatkan dari produk tersebut.

The Role of Digestion in Nutrient Absorption

Dalam tubuh kita, pencernaan memainkan peran penting dalam penyerapan nutrisi. Bagaimana produk diproses oleh sistem pencernaan kita dapat mempengaruhi sejauh mana nutrisi dapat diserap dan dimanfaatkan oleh tubuh.

Sebagai contoh, jika makanan dikonsumsi bersamaan dengan makanan yang mengandung lemak, penyerapan beberapa nutrisi akan lebih efisien karena mereka larut dalam lemak dan dapat dengan mudah diangkut oleh lipid dalam makanan.

Pengaruh Waktu Terhadap Efektivitas Produk

Setiap jenis produk memiliki waktu yang ideal untuk dikonsumsi agar memberikan hasil yang maksimal. Misalnya, jika Anda mengonsumsi suplemen kebugaran sebelum latihan, Anda mungkin akan merasakan peningkatan energi dan performa selama latihan.

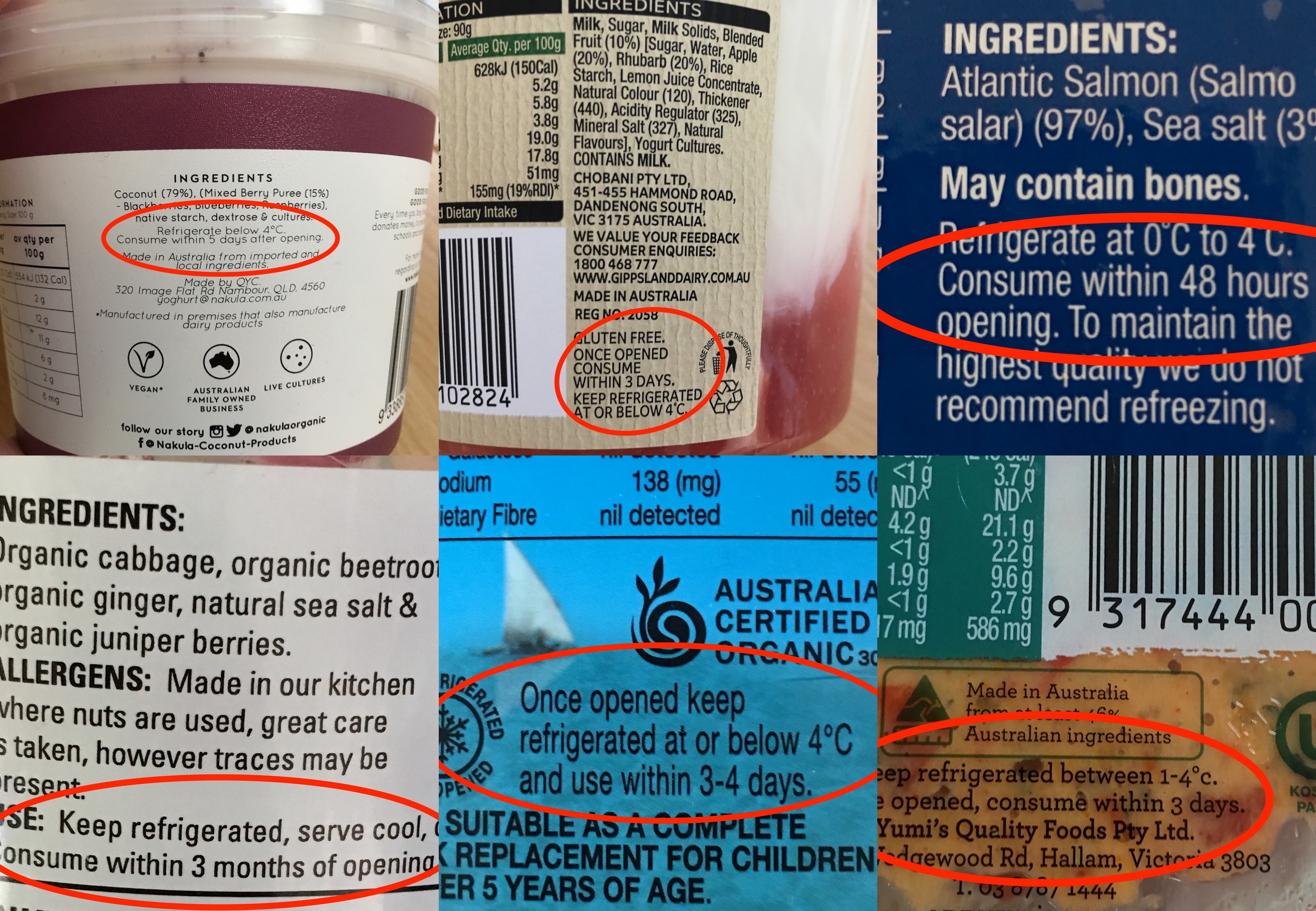

Namun, waktu yang tepat untuk mengonsumsi produk itu sendiri dapat bervariasi tergantung pada jenis produk, tujuan Anda, dan kebutuhan individu. Mari kita bahas beberapa produk umum dan kapan waktu yang tepat untuk mengonsumsinya.

Best Time to Consume Different Products

Di bagian ini, kita akan membahas waktu terbaik untuk mengonsumsi beberapa produk umum, seperti suplemen vitamin, suplemen protein, dan banyak lagi. Ini adalah panduan umum dan mungkin tidak berlaku untuk setiap individu, oleh karena itu penting untuk berkonsultasi dengan profesional kesehatan sebelum mengubah jadwal konsumsi produk yang ada.

Vitamin Supplements

Suplemen vitamin biasanya dapat dikonsumsi kapan saja dalam sehari, tetapi ada beberapa pengecualian tergantung pada jenis vitamin yang Anda konsumsi. Misalnya, vitamin C dan vitamin B kompleks yang larut dalam air lebih baik diserap saat dikonsumsi bersamaan dengan makanan.

Sedangkan vitamin A, D, E, dan K yang larut dalam lemak lebih baik diserap saat dikonsumsi bersamaan dengan makanan yang mengandung lemak.

Protein Supplements

Suplemen protein biasanya dikonsumsi segera setelah latihan untuk membantu pemulihan otot dan pertumbuhan. Namun, beberapa orang mungkin juga mengonsumsi protein sebelum tidur untuk membantu meningkatkan sintesis protein semalaman.

Weight Loss Supplements

Suplemen penurunan berat badan biasanya dikonsumsi sebelum atau selama makan untuk membantu mengontrol nafsu makan dan meningkatkan metabolisme. Namun, penting juga untuk memperhatikan dosis dan bahan-bahan suplemen penurunan berat badan, serta berkonsultasi dengan profesional kesehatan jika Anda memiliki kondisi medis atau sedang mengonsumsi obat-obatan.

FAQ (Frequently Asked Questions)

1. Should I take vitamin supplements in the morning or at night?

It depends on the type of vitamin supplement. Water-soluble vitamins are best taken with meals, while fat-soluble vitamins are better absorbed when taken with dietary fat. Consult with a healthcare professional for personalized advice.

2. Can I take protein supplements before bed?

Consuming protein supplements before bed can help support muscle recovery and growth during sleep. However, individual needs and preferences may vary, so it’s best to consult with a healthcare professional.

3. Can weight loss supplements be taken on an empty stomach?

Weight loss supplements are often taken before or during meals to help control appetite and enhance metabolism. However, it’s important to read the instructions and consult with a healthcare professional before taking them on an empty stomach.

// Continue the FAQ with 7 more questions and answers.

Conclusion

Untuk memaksimalkan manfaat dari sebuah produk, waktu pengonsumsian harus diperhatikan dengan seksama. Berdasarkan jenis produk dan kebutuhan individu, waktu yang tepat untuk mengonsumsi produk tertentu dapat bervariasi. Konsultasikanlah dengan profesional kesehatan untuk mendapatkan saran yang disesuaikan dengan kebutuhan Anda. Ingatlah bahwa meskipun waktu penting, tetap memprioritaskan asupan makanan yang sehat dan gaya hidup aktif sebagai dasar perawatan kesehatan Anda.

Originally posted 2023-07-15 08:43:12.